- Solutions

Healthcare

- Resources

Why run this play?

After delivering services that are accident or injury related, it’s important to submit the initial claim to the appropriate TPL (Third Party Liability) payer, whether auto, liability, or worker’s compensation. This speeds processing and payment, and decreases accident/injury denials. Just as importantly, it prevents underpayments caused by incorrectly submitting the initial claim to an invalid payer like Medicaid where a lot of underpayments in this regard typically occur.

Background

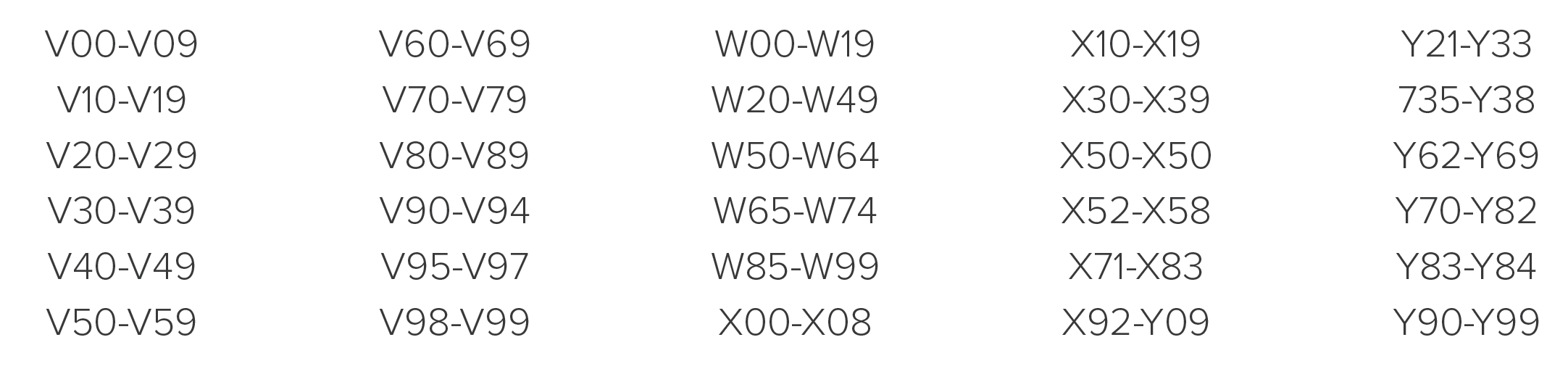

Specific ICD-10 Dx code ranges can identify potential accident or injury related services that may need to be sent to a carrier other than the patient’s health insurance. Proactively identifying patient accounts before the initial claim is submitted ensures that the proper insurance is assigned to the account. In states where Third Party Liability (TPL) payers are primary over health insurance, this is especially important. For example, when Medicaid is billed as primary in these states, providers are forced to accept that payment as payment in full and are not permitted to bill or rebill to the correct third party. This can be a significant – and totally avoidable – decrease in reimbursement.

Take Action

- Create a report on your DNFB A/R filtered for the following ICD-10 Dx codes.

- Include the following fields: Primary Insurance, Total Charges, Total Payments, “Count or Qty” of Accounts and A/R Outstanding.

- Group the report by Primary Insurance and sort in descending order.

- For each qualifying account, check to be sure the primary insurance is correct. This may require reviewing documentation – medical records or accident/injury forms to identify another party that may be responsible for the injury. Obtaining the correct TPL information may require a call to the patient or insurance carrier (if information provided at the time/point of service.

Want to see how to run this play in VisiQuate?

Request a demoHow to Calculate This Play's Value

This play creates value by accelerating cash in several ways. It reduces or eliminates cases where the Payer stalls payment by demanding Accident Details and/or Med Records, or ultimately denies the claim. It also decreases the probability that the account will be unnecessarily written off, or passed inappropriately to the patient.

- To capture ROI for this play, identify the date when you identified the issue.

- Create a report that trends “accident/injury” pended payment delays and/or denials using the following CARC codes: 160, 19 and 215. Capture the Reduction in Net Denial Amount.

- Create a report that captures all payments posted to an account after the insurance is updated.

- If your organization practices dispositional claims management, simply trend Accounts Pended for Accident Details/Med Records requests. A downward trend of this status and disposition means that more inventory is in a results-oriented Disposition, and that fewer touches are needed to resolve the account.

Be the first to know when a new play comes out.

Sign up now!© 2024 VisiQuate, Inc. All Rights Reserved.

- Create a report on your DNFB A/R filtered for the following ICD-10 Dx codes.